In this article:

- Best Health Insurance Plans for Self-Employed Individuals

- Understanding Self-Employed Health Coverage

- What Is the ACA Marketplace?

- What Is Short-Term Health Coverage?

- Bottom Line

Navigating health insurance as a self-employed professional can feel like walking a tightrope. Without the safety net of an HR department or employer-sponsored coverage, you’re responsible for finding a plan that protects both your health and your business’s financial stability. Whether you’re a freelancer, consultant, or small business owner, choosing the right health insurance is crucial.

This comprehensive guide explores the top health insurance carriers for self-employed Americans in 2026, featuring ACA marketplace and supplemental coverage options tailored to independent professionals.

Best Health Insurance Plans for Self-Employed Individuals

1. Solo Health Collective – Best for Solopreneurs and Business-of-One Professionals

Overview: Solo Health Collective revolutionizes health insurance for independent professionals by offering a captive framework that allows solopreneurs to build a personalized health plan. Designed specifically for businesses of one, Solo provides comprehensive major medical coverage with nationwide access and robust financial protection.

Money Note: If an extra $1K–$5K/month would change your 2026 goals (debt, savings, travel, freedom), you’ll want to catch this: free live workshop from a freelancer who’s earned $4M+ online. No fluff. No gimmicks. A real roadmap. 👉 Watch the training or save your seat here »

Key Features:

- Comprehensive Coverage: Nationwide access to 1.4M+ healthcare providers

- Preventive Services: Routine checkups, screenings, and immunizations fully covered

- Flexible Plan Options: Three deductible levels ($2,500, $5,000, $10,000)

- Network: MultiPlan PHCS offering extensive provider choices

- Best For: Entrepreneurs seeking customizable, affordable health coverage designed for independent professionals

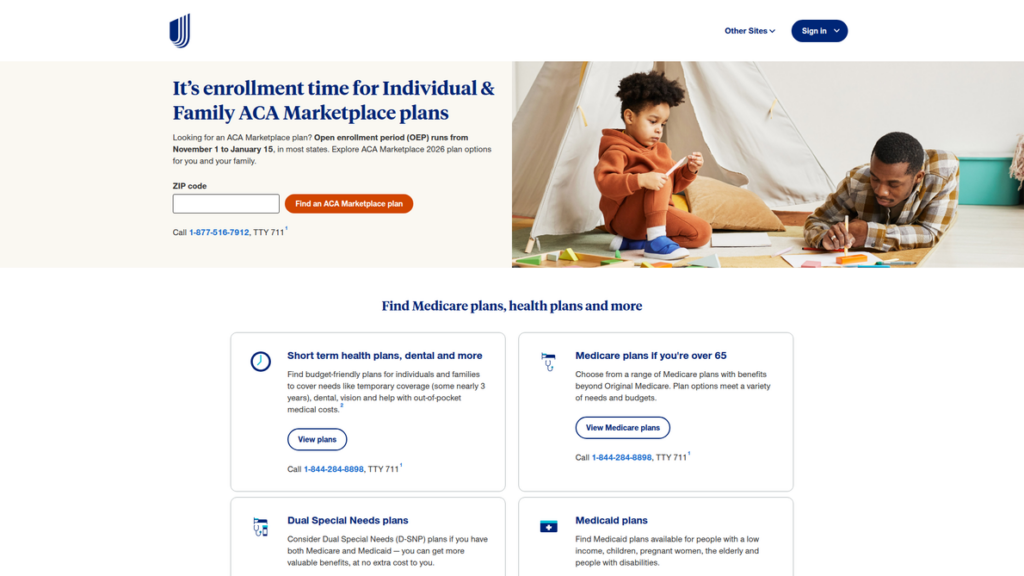

2. UnitedHealthcare (UHC) – Best for Combining ACA and Short-Term Coverage

Overview: UnitedHealthcare blends national ACA access with short-term health coverage, providing an ideal solution for freelancers and business owners in transition. Its extensive provider network offers comprehensive protection.

You Deserve Better Clients...

We can help you find them. Just send us the details and we'll hunt down leads that match your business needs. All on autopilot.

Key Features:

- HealthCare Insider Rating: 8/10

- Coverage: ACA in 30 states, Medicare, and short-term health options

- Extras: CareFlex Visa card, robust telehealth tools

- Global Coverage: Services in 130+ countries

- Best For: Self-employed individuals needing versatile coverage options

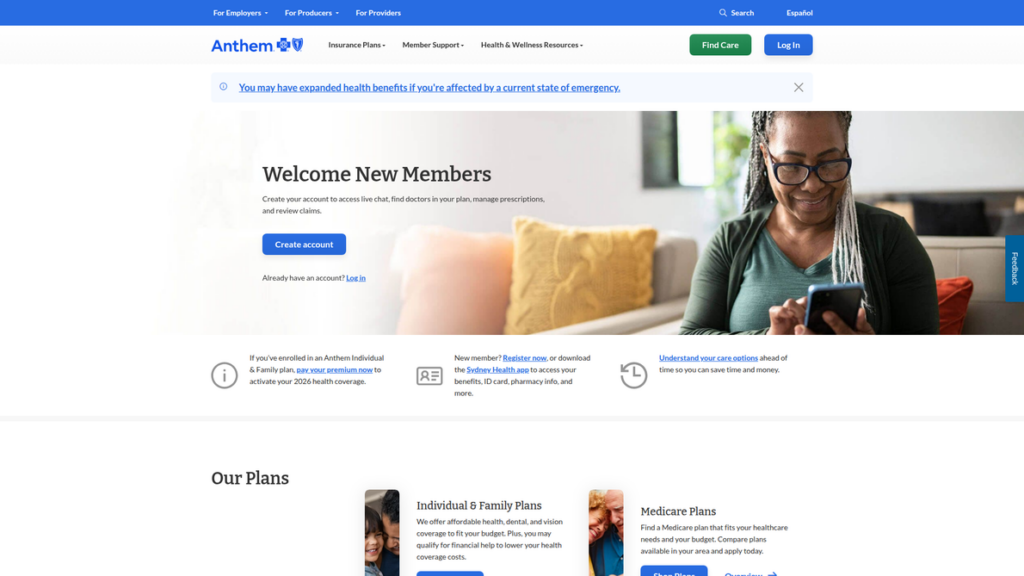

3. Anthem Blue Cross Blue Shield – Best for Affordable ACA Plans

Overview: Anthem operates ACA plans in 14 states with access to the BCBS national network. Known for low-cost ACA options and “Essential Extras” benefits, it’s a top pick for affordable, regional self-employed coverage.

Key Features:

- HealthCare Insider Rating: 8/10

- Coverage: ACA, Medicare Advantage, and limited short-term plans

- Perks: Dental, vision, hearing, grocery, and utility benefits

- Affordability: Low-cost ACA tiers and strong subsidies

- Best For: Self-employed workers in Anthem states seeking affordable coverage

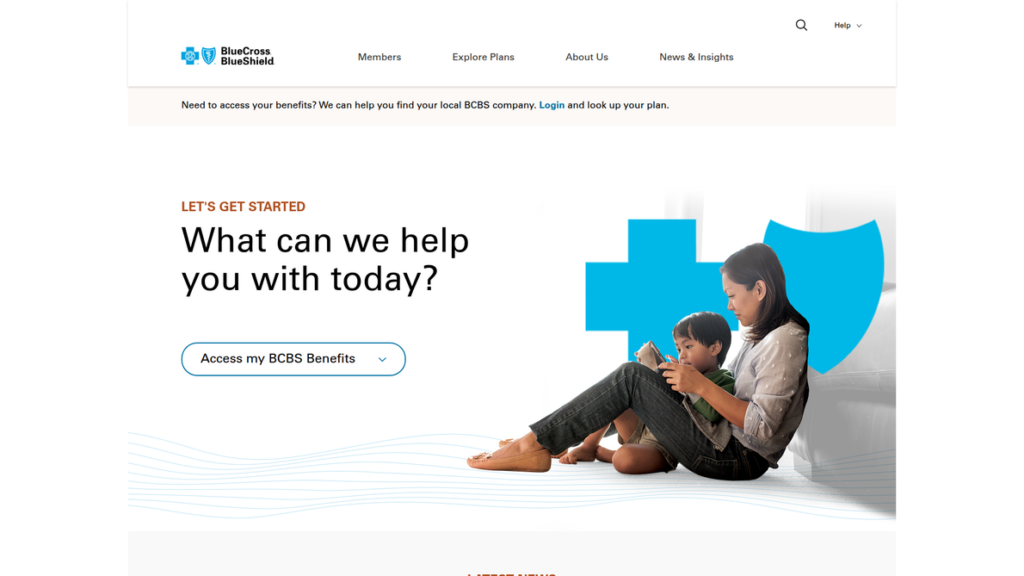

4. Blue Cross Blue Shield (BCBS) – Best for Nationwide Coverage

Overview: Blue Cross Blue Shield remains a powerhouse, offering ACA marketplace and Medicare plans across every state, D.C., and Puerto Rico. Its extensive network makes it an ideal choice for self-employed professionals requiring broad geographical coverage.

Key Features:

- HealthCare Insider Rating: 8.4/10

- Coverage: ACA, Medicare, Medicaid, and select short-term plans

- Network: Largest in the U.S. with global emergency access

- Affordability: Competitive pricing with strong subsidy options

- Best For: Self-employed professionals needing multi-state flexibility

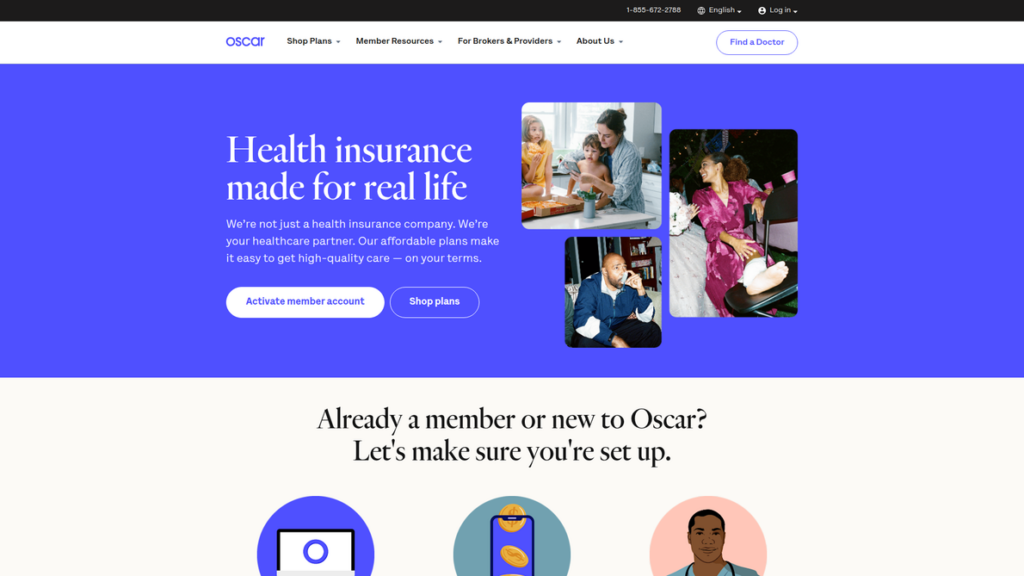

5. Oscar Health – Best for Digital-First and Virtual Care

Overview: Oscar Health delivers a sleek, user-friendly experience built around telehealth and app-based tools. It’s designed for self-employed consumers who prefer simplicity and digital access to care.

Key Features:

- HealthCare Insider Rating: 6.6/10

- Coverage: ACA and Medicare Advantage in 18 states

- Innovation: $0 virtual urgent care, Care Teams for chronic conditions

- Affordability: Competitive ACA pricing

- Best For: Tech-savvy entrepreneurs preferring online healthcare management

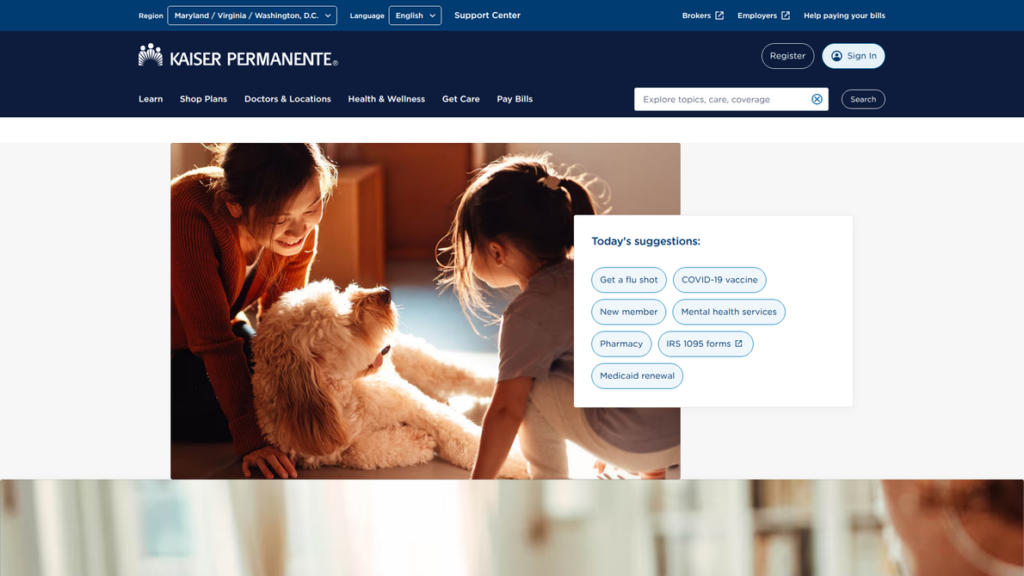

6. Kaiser Permanente – Best for Quality and Coordinated Care

Overview: Kaiser Permanente’s integrated model—combining insurance, doctors, and hospitals—earns top marks for quality and member satisfaction. Available in eight states and D.C., it’s ideal for those who prioritize preventive care and digital convenience.

Key Features:

- HealthCare Insider Rating: 8.4/10

- Coverage: ACA, Medicaid, Medicare Advantage

- Care Quality: Consistently top-rated for preventive care outcomes

- Affordability: Competitive pricing with many $0 premium tiers

- Best For: Independent professionals seeking comprehensive, coordinated care

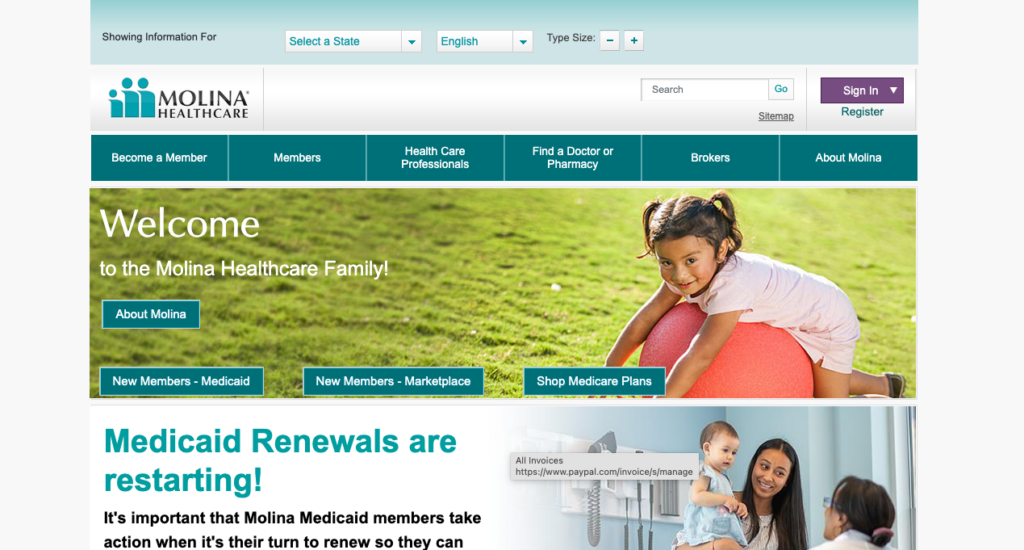

7. Molina Healthcare – Best for Budget-Friendly ACA and Medicaid Options

Overview: Molina Healthcare offers ACA, Medicaid, and Medicare Advantage plans across 15+ states, focusing on value-based, low-premium coverage for self-employed individuals prioritizing affordability.

Key Features:

- HealthCare Insider Rating: 5.8/10

- Coverage: ACA, Medicaid, and Medicare

- Affordability: Very low premiums and deductibles

- Network: Regional with limited provider access

- Best For: Lower-income self-employed individuals seeking essential protection

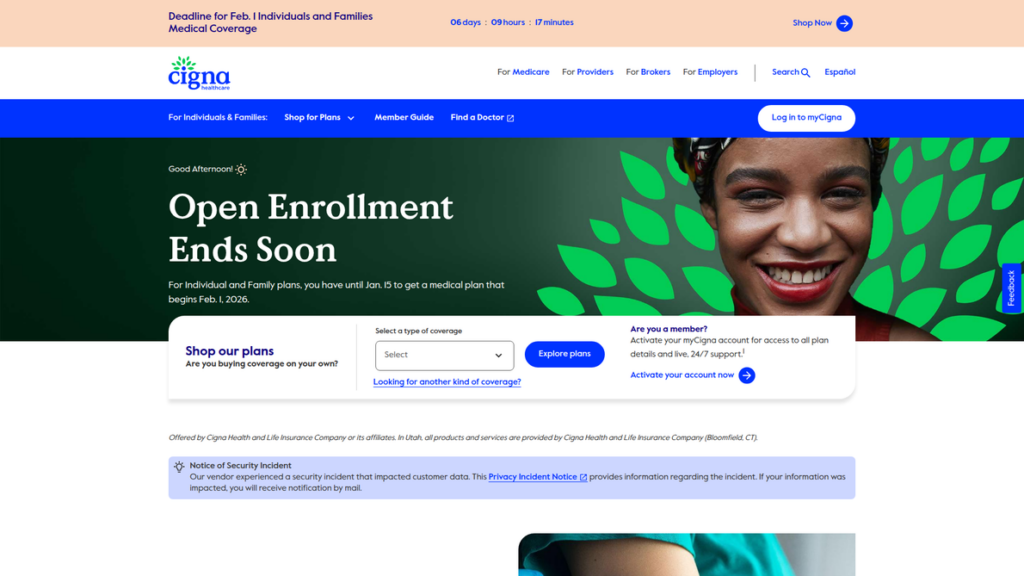

8. Cigna Health and Life Insurance – Best for Global Coverage

Overview: Cigna offers ACA and international plans in 11 U.S. states and over 200 countries globally. It’s a strong fit for self-employed business owners who travel frequently or manage international clients.

Key Features:

- HealthCare Insider Rating: 4.8/10

- Coverage: ACA, Medicare, Medigap, and global health plans

- Strengths: Global access and robust telehealth tools

- Challenges: Rising premiums and lower satisfaction ratings

- Best For: Self-employed professionals needing U.S. and international coverage

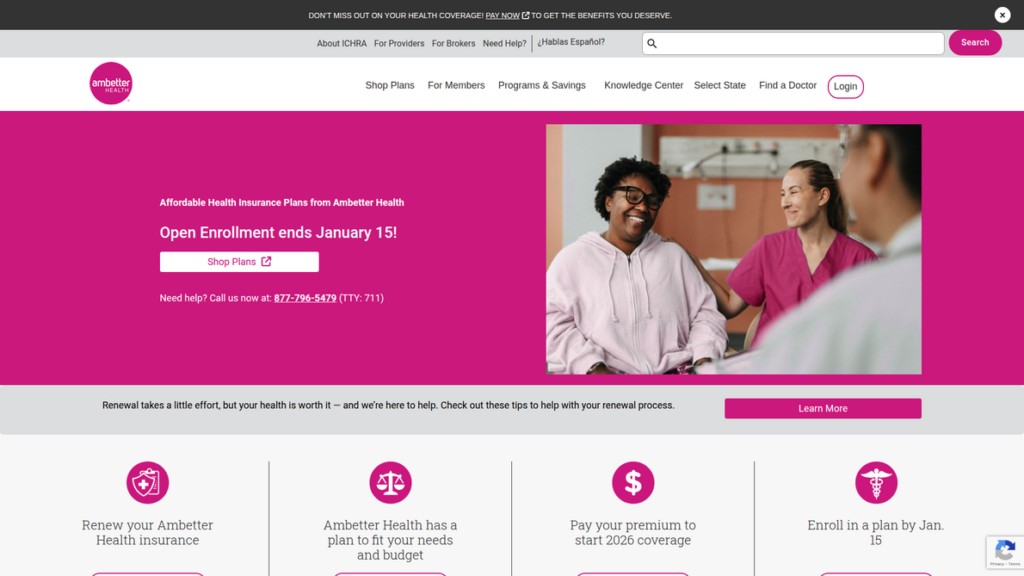

9. Ambetter (Centene) – Best for Low-Cost ACA Marketplace Plans

Overview: Ambetter focuses on affordability with ACA marketplace coverage in 29 states. It’s popular among self-employed individuals who qualify for subsidies and prefer low premiums with wellness benefits.

Key Features:

- HealthCare Insider Rating: 6/10

- Coverage: ACA in 29 states

- Perks: Wellness rewards up to $500 per year, 24/7 telehealth

- Affordability: Among the lowest ACA premiums available

- Best For: Cost-conscious freelancers wanting essential coverage

Understanding Self-Employed Health Coverage

Self-employed professionals have multiple avenues for obtaining health insurance. The Affordable Care Act (ACA) Marketplace offers individual and family plans, with potential premium tax credits based on income fluctuations.

ACA Marketplace Highlights

- Potential subsidies based on income

- Essential health benefits included

- Enrollment typically runs November 1–January 15

- Flexibility to update coverage as your business changes

What Is the ACA Marketplace?

The Affordable Care Act (ACA) Marketplace is a federally managed platform where individuals and families can compare and purchase qualified health plans that meet national coverage standards.

What Is Short-Term Health Coverage?

Short-term medical plans are temporary insurance options designed to bridge gaps in coverage for individuals in transition, such as those waiting for Marketplace coverage or newly self-employed individuals.

Bottom Line

Selecting the best health insurance depends on your location, healthcare needs, and income level. Consider these recommendations:

- Use Solo Health for tailored solopreneur coverage

- Choose BCBS or UHC for reliable national coverage

- Opt for Kaiser or Anthem for integrated, quality care

- Explore Ambetter or Molina for budget-friendly options

- Treat short-term plans as temporary bridges, not permanent solutions

One more thing...

You didn't start freelancing to spend hours every week searching through job boards. You started freelancing to do more work you enjoy! Here at SolidGigs, we want to help you spend less time hunting and more time doing work you love.

Our team of "Gig Hunters"—together with the power of A.I.—sends you high-quality leads every weekday on autopilot. You can learn more or sign up here. Happy Freelancing!